Ohio Tax Incentives

What to do when the Affordable Care Act Impacts Case Settlements:

The Benefits of an Accessibility-Focused Case Evaluation

A White Paper by Michael Fiore

One of the likely unintended consequences of the Affordable Care Act is that Special Need Trusts may be impacted due to settlement criteria that can be based on past, present, and future medical needs.

Teleseminars on Disability, Diversity, and the Changing Workforce. One hour of learning that can change the way that you think.

Tech Update: Read an article about the implications of 32-bit and 64-bit processors for Assistive Technology Solutions.

Looking for qualified candidates with disabilities?

![]()

A Job Board for job seekers with disabilities and the businesses looking to hire them.

Ohio Tax Incentives

Page Contents

- Assistive Technology of Ohio – Device Library

- Business Incentives Tax Credits

- Business Incentives to Help You Locate Your Next Expansion in Ohio

- Business Resources for Ohio Employers

- Chamber of Commerce

- Collateral Enhancement Program

- Computers for Ohioans with Disabilities

- Department of Development

- Hiring Job Seekers with Disabilities

- InvestOhio

- Job Creation Tax Credit

- Minority Business Bonding Program

- Minority Direct Loan Program

- Ohio Business Gateway

- Ohio Capital Access Program

- Ohio Enterprise Zone Program

- Ohio Incumbent Workforce Training Voucher Program

- Ohio New Markets Tax Credit

- Ohio State Apprenticeship Council

- Opportunities for Ohioans with Disabilities

- Regional 166 Direct Loan

Assistive Technology of Ohio – Device Library

A wide variety of assistive technology devices are available to borrow from our library. Items that are currently available are listed below. Items may be borrowed for 30 days. If a requested device is out on loan, the applicant will be placed on a waiting list. In order to borrow a device, a request form must be completed and submitted to AT Ohio.

Assistive technology is any device that enables a person with a disability to be more functional. Using the proper technology at work will allow a disabled person to be more productive, and in turn, a better worker.

Assistive Technology Online Request Form

Business Incentives Tax Credits

Twelve investment and incentive programs are offered to Ohio businesses clearly explaining funding mechanisms, incentive plans, and application procedures. The programs focuses resources in businesses that expand or locate in Ohio, retain jobs, invest in research/technology and train employees; especially employees with disabilities.

Business Incentives to Help You Locate Your Next Expansion in Ohio

Business Incentives To Help You Locate Your Next Expansion in Ohio PDF

Information on site development assistance, loans/grants PDF

Using this information, an employer will be able to make a work site ADA compliant, obtain funding for assistive technology and hire/train workers with disabilities.

Business Resources for Ohio Employers

Ohio resources for making good business decisions PDF

The resources described can be used by businesses to include employees with disabilities as part of their workforce.

Chamber of Commerce

The Ohio Chamber of Commerce is dedicated to presenting Ohio lawmakers with the business perspective on issues. As Ohio's largest and most diverse statewide business advocacy group, the Chamber has been a consistent voice for business for more than a century.

Collateral Enhancement Program

The Ohio Development Services Agency's Collateral Enhancement Program was created to facilitate increased lending by banks to small businesses, minority- and women-owned businesses, and businesses located in HubZone areas that need access to capital for growth or expansion. The Collateral Enhancement Program is designed to enable financing that might otherwise be unavailable due to a collateral shortfall. The program supplies pledged cash collateral accounts to lending institutions to enhance collateral coverage of individual small business loans. The program is designed to target certain situations or industries, such as manufacturing, in which there is a collateral shortfall.

Computers for Ohioans with Disabilities

Assistive technology of Ohio will help people with disabilities obtain computers. To participate in this program, an application packet must be submitted.

All the application forms and contact information can be found on assistive technology of Ohio website.

Computer Application Form DOCX

Department of Development

The Ohio Department of Development works to attract, create, grow, and retain businesses through competitive incentives and meaningful, targeted investments.

Hiring Job Seekers with Disabilities

Hiring Job Seekers with Disabilities has links and general information on hiring and employing workers with disabilities.

InvestOhio

InvestOhio is a tool to provide much needed capital into Ohio's small businesses, helping them create jobs. The nearly 900,000 small businesses in Ohio are one of the backbones of the state's economy. InvestOhio encourages investors to actively support these small businesses, sparking growth and improving Ohio's competitive position. The program, administered by the Ohio Development Services Agency in collaboration with the Ohio Department of Taxation, generated nearly $700 million dollars of investment in the state in the previous biennium and is expected to continue to generate investment to the state moving forward.

The jobs created as a result of this program could be held by workers with disabilities.

Minority Business Bonding Program

The Minority Business Bonding Program provides bid, performance, and payment surety bonds to state certified minority-owned businesses that are unable to obtain bonding through standard surety companies. To be eligible for this program, the project for which bonding is sought must be economically feasible; and the minority business must not have defaulted on a previous bond issued by the Ohio Development Services Agency. The maximum bonding line pre-qualification is $1 million per business. The premium for each bond requested is 2 percent of the face value of the bond. The business must demonstrate the benefit to Ohio residents by increasing employment opportunities. The collateral and/or security are the personal guarantees of the principals and persons substantially involved in business operations, and other such collateral as warranted.

A business owner who has a disability may be eligible for this program.

Minority Direct Loan Program

The Minority Direct Loan Program provides fixed, low-interest rate loans to certified minority-owned businesses that are purchasing or improving fixed assets and creating or retaining jobs. The loans can be used to finance up to 40 percent of the project value. The Minority Direct Loan Program focuses on several factors to determine the eligibility, chief among those determinations are the number of jobs created and/or retained as a result of the State’s investment, the extent of participation by the business and a conventional lender in the project; and the demonstration by the business that the State’s assistance is necessary in order for the project to go forward.

To reduce unemployment among people with disabilities in Ohio, jobs created with the support of this program can go to workers with disabilities.

Ohio Businesses Gateway

The Ohio Business Gateway is about making government accessible to businesses by helping find the information and services needed to keep them thriving in Ohio.

Ohio Capital Access Program

The Ohio Capital Access Program (OCAP) is a loan portfolio insurance program (similar to a loan a guarantee) that enables small businesses to obtain credit to help them grow and expand their businesses. With OCAP, when a participating Lender originates a loan, the Lender and Borrower combine to contribute a percentage of the loan (from 3 percent to 6 percent) into a reserve fund, held by the Lender. The Ohio Development Services Agency also sends a state contribution to the Lender-held reserve fund. Each Lender's total OCAP reserve fund is available to cover losses on any loan in the Lender's OCAP portfolio. OCAP loans are originated and serviced by the Lender. The Ohio Development Services Agency also uses funds from the State Small Business Credit Initiative to make contributions to the reserve fund.

With financial assistance from this program, an entrepreneur with a disability would be able to start or grow a business.

Ohio Enterprise Zone Program

The Ohio Enterprise Zone Program is an economic development tool administered by municipal and county governments that provides real and personal property tax exemptions to businesses making investments in Ohio.

The jobs created as a result of this program can benefit the residents of the zones who have disabilities and searching for gainful employment.

Ohio Enterprise Zone Program Information Guide DOC

Enterprise Zone Program Application DOC

Ohio Incumbent Workforce Training Voucher Program

The Ohio Incumbent Workforce Training Voucher Program fills a gap in current workforce development programs by providing needed training dollars to Ohio's incumbent workforce through a unique public-private partnership. The ultimate goal of this program is twofold: allow employers to retain and grow their existing Ohio workforce and create a statewide workforce that can meet the present and future demands in an ever changing economy.

Workers with disabilities can benefit from this program by receiving vocational training, which will help them retain their current jobs.

Start the Ohio Incumbent Workforce Training Voucher Program application process.

Ohio Job Creation Tax Credit

The Ohio Job Creation Tax Credit Program was established in 1993. The program provides a refundable tax credit against a company's corporate franchise or income tax based on the state income tax withheld from new, full-time employees.

Agreement Amendment Request Form PDF

Ohio New Markets Tax Credit Program

The Ohio New Markets Tax Credit Program helps to finance business investments in low-income communities by providing investors with state tax credits in exchange for delivering below-market-rate investment options to Ohio businesses. Investors receive a 39% tax credit spread over seven years if they make an investment in a qualified low-income community business.

The program helps to spark revitalization in Ohio's communities with this attractive tax credit. In doing so, it could create more employment opportunities, especially for job seekers who have disabilities.

New Market Tax Credit Guidelines PDF

New Market Tax Credit Application PDF

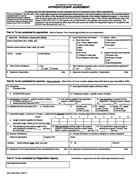

Ohio State Apprenticeship Council

Ohio has over 900 Registered Apprenticeship programs that teach high-level skills for today's work-place. Each program includes, at minimum, 2000 hours of structured on-the-job training and 144 hours per year of related technical instructions.

The workers hired as apprentices can be job seekers with disabilities who are in need of job training and practical experience to secure gainful employment.

Ohio State Apprenticeship Brochure PDF

Voucher of Credit for Apprentice’s Previous Experience PDF

Certification of Apprenticeship Completion Application PDF

Opportunities for Ohioans with Disabilities

Opportunities for Ohioans with Disabilities is the State of Ohio agency that partners with Ohioans with disabilities to achieve quality employment and independence. It is also charged with making determinations on Social Security disability.

Opportunities for Ohioans with Disabilities can help provide job-ready workers with disabilities to fill an employer’s human resources needs. The agency offers recruitment, placement and retention services, training and technical assistance, resulting in satisfied employees and management. Training programs that assist business with accessibility compliance are also available. Most employer services are free to the employer or available for a nominal cost.

A map of Ohio and its counties. Click on a county to get the contact information for the Bureau of Vocational Rehabilitation office in that area.

Regional 166 Direct Loan

The Regional 166 Direct Loan Program (Regional 166 Direct Loan) promotes economic development, business expansion and job creation by providing financial assistance for allowable costs of eligible projects in the State of Ohio.

Renovating an existing workspace to make it ADA compliant is an appropriate use of this loan.